Guest Author -- Ten Tax Cuts And Who They Benefit

Since I'm currently on vacation, it was impossible for me to even attempt to put together a Friday Talking Points column this week. However, instead we are happy to be able to bring you a new original column from David Akadjian (who is, incidentally, one of our favorite CW.com commenters).

The subject is a timely one, as we get close to April 15 and everyone's attention turns to taxes. This article is an excellent breakdown of what a variety of past tax cuts meant to the average taxpaying Joe and Jane, as opposed to how they affected businesses and the top earners.

In any case, I highly recommend the following article, and I also should mention that I brought David's new book with me on my travels and am currently about halfway through it (click on the links at the very bottom of the article for more information).

Friday Talking Points will return in two weeks, but for now please enjoy the following.

-- Chris Weigant

Ten Tax Cuts And Who They Benefit

It's tax season once again and I'd like to address a question that I rarely see addressed: Who do tax cuts benefit?

To start, let's make a list of the major tax categories:

- Sales taxes

- Fees, tolls, and licenses

- Sin taxes (alcohol, tobacco, etc.)

- Capital gains taxes

- Estate taxes

- Luxury taxes

- Corporate income taxes

- Payroll taxes (FICA)

- Property taxes

- Income taxes

Taxes are, by and large, dues that run our country. We tend not to like them but we tend to like the things they pay for like education, public parks, security and defense, police departments, fire departments, trash collection, etc.

Our tax system was designed to be a progressive tax system with the idea that we want to create economic opportunity for as many people as possible. The more people benefit from the efforts of our country, the more people should pay back in to help make sure future generations have the same opportunity.

Jonathan Cohn at The New Republic describes investing in society this way:

[The proverbial self-made man] is benefiting from the accomplishments of past generations, not to mention the support of public institutions (like the National Science Foundation) and services (like schools) that foster innovation and lead to greater productivity.

With this in mind, let's look at a simple way to evaluate these taxes.

Who benefits from cuts to these taxes?

Consumption taxes are taxes on goods and services that everyone buys regularly like food and gas. As you make more money, you don't tend to buy more of these items so they affect everyone equally.

- Sales taxes tend to be consumption taxes unless they are on luxury items such as yachts or airplanes. Reducing sales taxes help consumers and everyone equally.

- Fees, tolls, and licenses act similarly to consumption taxes.

- Sin taxes. I'm going to assume that we all sin in some way, shape or form and include sin taxes as a consumption tax that impacts average people.

- Capital gains taxes affect the profit on investments. Cuts to capital gains taxes primarily benefit people who can afford to invest and disproportionately benefit the wealthy who hold most of their wealth in stocks.

- Estate taxes primarily affect the wealthy since there is usually a threshold below which there is no tax (at the federal level the threshold is $5.43 million in 2015).

- Taxes on luxury items also clearly impact the wealthy most as this is the group most likely to buy large luxury items.

- Corporate income taxes have to be paid by people since corporations are nothing more than pieces of paper. It's often assumed that taxes on corporations are passed on to consumers; this is false. Prices are determined by supply and demand independently of tax rates. If this seems counter-intuitive, ask yourself if you've ever seen a price go up or down because taxes were raised or lowered. This leaves two groups of people: shareholders and employees. Most economists agree the costs of corporate taxes are borne by these two groups though they disagree on the ratio. If you look at a number of estimates and average them, it's close to 20 percent labor and 80 percent shareholders. The tax policy center methodology estimates this same 80/20 shareholder to labor split. Using this 80/20 split, corporate tax cuts would mostly benefit shareholders which means they will disproportionately benefit stockholders or the top 1%.

- Payroll taxes are paid by both employees and employers. However, the economic burden of payroll taxes fall on workers as the employers' share of payroll taxes is passed on to employees in the form of lower wages [PDF].

- Property taxes are a bit tricky also. You might think property taxes affect only people who own property and also impact the wealthy more as they own the most property. First, property taxes can be passed on to renters in the form of higher rent. Second, property owners have ways to reduce or offset the amount they pay in property taxes. For example, property owners receive an income-tax deduction for interest paid on their homes. The more interest you're paying, the bigger the tax deduction. There are also often loopholes that allow people to declare their property a farm or some other type of business for a tax deduction. Long story short, property taxes are usually paid by average people.

- Income taxes. The United States and most states have a progressive income tax system. The idea is that as you make more and do better, you pay more back. For this reason, income taxes tend to be paid more by people who benefit more.

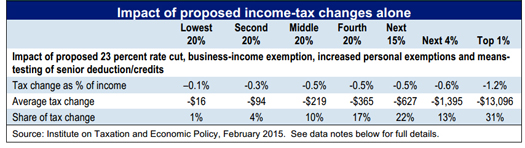

This example, from Ohio's 2015-16 proposed income tax changes, shows who would benefit most from income tax changes, the biggest being a 23% rate cut.

The top 1% would receive on average $13,096 while the next 4% would receive $1,395. Benefits drop off steeply for everyone else. Income tax cuts primarily benefit the wealthy.

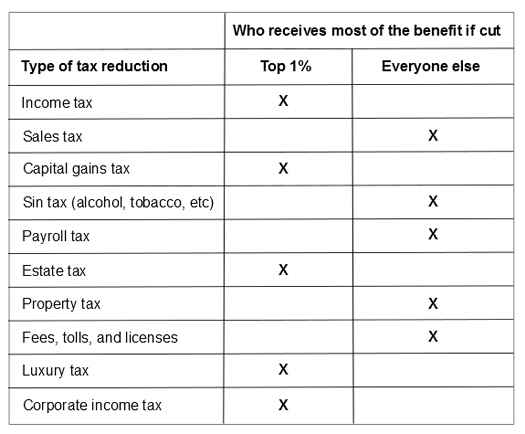

To summarize, here's a table that shows who benefits most from cuts to these 10 forms of taxation:

If we want people to benefit, we would cut property taxes, sales taxes, fee, tolls, and licenses, sin taxes and payroll taxes.

If we want to benefit the wealthy, we would cut corporate taxes, capital gains taxes, income taxes, luxury taxes and the estate tax.

Taxes and Wall Street

In 1978, Jude Wanniski, penned the article "A Bull Market Scenario" in the Wall Street Journal. The question he asked was:

What will it take to get the Dow Jones Industrial Average to a level of 3000 or 4000 by the early 1980s?

Wanniski theorized that when something has happened before it could happen again. What he was referring to was a nearly five-fold rise in the stock market from 1921 to 1929 under Calvin Coolidge. Coolidge believed “generally speaking, the business of the American people is business” and lowered taxes to the point where in 1927, only the wealthiest 2% of taxpayers paid any federal income tax.

Wanniski's idea was to duplicate the Coolidge plan:

As in the 1920's, we can expect a gradual, then accelerating dismantling of the government barriers between effort and reward. An era of incentives. The most important of these barriers are the now unnecessarily high federal tax rates on capital gains, personal incomes, and gifts and estates. Also a diminution of federal regulatory barriers to commerce.

Sound familiar?

If you want the stock market to go up, the way to do this is to cut taxes on the wealthy and corporations (the capital gains tax, income taxes, corporate taxes, estate taxes, etc.). These taxes are taxes on accumulated wealth and capital. If you want to juice the stock market, eliminate taxes on accumulated wealth and capital.

Certain tax cuts benefit Wall Street and the wealthy.

Taxes that don't fall into this category are the taxes paid by everyday people: sales taxes, property taxes, sin taxes, government fees and tolls.

Look for these taxes to be raised.

Wanniski's article became one of the cornerstones of supply-side economics under President Reagan. Cutting these taxes doesn't boost the economy. It doesn't boost demand. It doesn't create jobs. It doesn't help the middle class.

As Wanniski points out, these tax cuts benefit investors and juice the stock market.

Example: National taxes since 1978

How well have we followed the Wall Street plan?

In 1978, the Carter administration reduced [PDF] the top tax rate on capital gains to 28% from 39%, reduced income taxes, increased the capital gains exclusion rate from 50% to 60%, and reduced the corporate tax rate from 48% to 46%.

Score: Top 1% -- 4 ; Everybody Else -- 0

In 1981, Reagan passed the Economic Recovery Tax Act (ERTA). This included:

- Across-the-board income tax cuts. The top income tax rate dropped from 70% to 50%; the bottom rate dropped from 14% to 11%.

- Raising the estate tax exemption to $600,000.

These cuts were based on the idea that we could cut taxes and increase revenue through greater growth. Unfortunately, so much revenue was lost that Congress had to close several loopholes opened by the ERTA only a year later with the Tax Equity and Fiscal Responsibility Act (TEFRA) of 1982.

Score: Top 1% -- 6 ; Everybody Else -- 0

What we don't often hear is that Social Security taxes were raised five times from 1977 to 1990. Social security taxes are the biggest tax paid by ordinary people, according to Reagan:

For the nation's work force, the Social Security tax is already the biggest tax they pay. In 1935 we were told the tax would never be greater than 2% of the first $3,000 of earnings. It is presently 13.3% of the first $29,700, and the scheduled increases will take it to 15.3% of the first $60,600.

These tax increases on workers subsidized tax cuts for corporations and the wealthy, like the capital gains tax cuts and the estate tax cut.

Score: Top 1% -- 11 ; Everybody Else -- 0

In 1986, in the second of Reagan's two major tax overhauls, the top tax rate for individuals was reduced from 50% to 28%, while the bottom rate was raised from 11% to 15%.

Score: 13-0

As a result of the trickle down tax cuts of the 1980s, revenue fell and the deficit rose. That led President H.W. Bush to raise taxes in 1990 to try to keep the deficit in check.

Score: 13-1

In 1993, President Clinton raised the top two income tax rates slightly and raised the corporate tax rate 1% (from 34% to 35%). However, he also increased the share of Social Security benefits that could be taxed and raised the sales tax on fuel (a consumption tax that affects consumers more than businesses).

Score: 15-3

In 1997, however, Clinton reduced the capital gains tax from 28% to 20% and raised the exemption on the estate tax to $1 million from $600,000.

Score: 17-3

George W. Bush accelerated the push in 2001 and 2003 with more tax cuts heavily favoring the wealthy. The exemption for the estate tax was raised to $5 million and the rate reduced. The Center on Budget and Policy Priorities estimates that 24.2% of tax savings from these changes went to the top 1%.

Score: 20-3

In 2010, the Bush tax cuts were up for renewal. President Obama fought to renew them for those earning less than $200,000 ($250,000 for joint filers). The U.S. Chamber vigorously fought leaving out those who earned more and eventually a compromise was reached where the original changes were extended for 2 years in exchange for some economic stimulus measures and a temporary 1-year reduction in the payroll tax.

Score: 21-4

In 2012, the Bush tax cuts came up again. This time President Obama proposed making the tax cuts permanent for those with taxable incomes of $400,000 ($450,000 for joint filers) or less. For those above this level, the rate was increased from 35% to 39.6% and the capital gains tax was also raised from 15% to 20%. The payroll tax deduction from 2010 was eliminated.

Final Score: Top 1% -- 22 ; Everybody Else -- 6

Using this very simple method of scoring tax cuts, it's pretty clear who receives most of the benefit of tax changes in America. This is largely the result of corporate special interest group lobbying by groups like the U.S. Chamber of Commerce, the largest special interest group in the country.

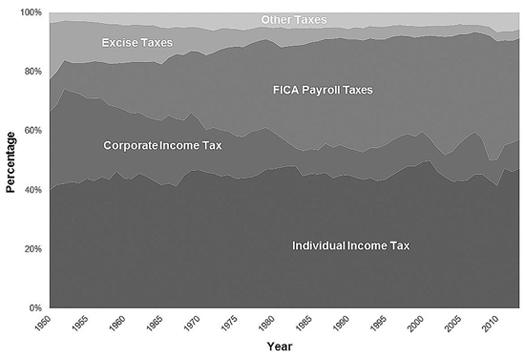

In 1952, corporate income taxes provided 32.1% of federal revenue. By 2013, corporate income taxes provided only 9.9%. In 1952, FICA payroll taxes provided 9.7% of federal revenue. In 2013, FICA payroll taxes provided 34.2%. Excise taxes including the estate tax provided 19.1% of federal revenue in 1952. By 2013, excise taxes provided only 5.5% of federal revenue.

If you score the tax changes at the national level using the table illustrating who they benefit, almost all of the tax changes have been designed to benefit the wealthy and Wall Street. Wanniski's plan has come to fruition.

Not surprisingly, Wall Street is doing quite well, average people are not. Benefits were supposed to trickle down – they didn't. The rising tide lifted a few yachts but rolled right over most.

Wrap

National and state budgets and tax plans are not easy to decipher. Especially since most of the business reporting in our country is just that, reporting done by our largest businesses. The report? We're doing quite well, thank you, and we'd like to pay even less to states and the United States.

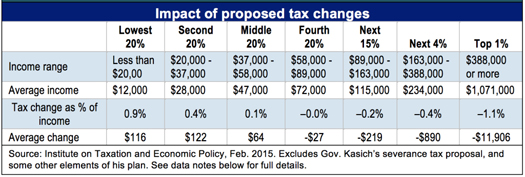

In Ohio, our state legislature is lowering income taxes and corporate income taxes and raising sales taxes, property taxes, sin taxes, and fees, tolls, and license costs.

In other words, Ohio is shifting who pays from the wealthy to everyone else. Those who have benefitted most are voting themselves exemptions and everyone else is being asked to pay more. This is what the sum of the proposed tax changes in Ohio looks like:

Everyone making $58K or less is being asked to pay more. The people who benefit the most are the 1%.

The belief is that the 1% will invest and create more jobs. The problem with this belief is that anyone who's taken even the most basic business courses knows that you hire people when there's an increase in demand, not when you receive a check, and taking money from consumers (70% of GDP spending) reduces demand.

This situation won't change until enough people mobilize for an economy that works for everyone, not just a few.

Use this handy guide to evaluate these proposals and ask the following:

- Who will tax changes benefit?

- Will you be paying more as a result of these changes?

- Are we getting anything in return?

- Do we want a country where the only people who benefit from all our efforts are owners and investors?

-- David Akadjian

[Image sources:]

- Student iPad School -- Brad & Lexie Flickinger, https://flic.kr/p/b9wzna (Creative Commons)

- Impact of proposed Ohio income tax changes -- Report from Policy Matters Ohio, http://www.policymattersohio.org/kasich-tax-proposal-feb2015

- Table of tax cut benefits -- Original graphic, David Akadjian

- United States tax revenue sources -- David Akadjian, produced from historical tables, http://www.whitehouse.gov/omb/budget/Historicals

- Impact of all proposed Ohio tax changes -- Report from Policy Matters Ohio, http://www.policymattersohio.org/kasich-tax-proposal-feb2015

|

David Akadjian designs sales, negotiation, and communication training for some of the top companies in the world. He writes about how to have political conversations with the people you know (without killing yourself) and is also the author of: The Little Book of Revolution: A Distributive Strategy for Democracy. [Click for more information.] Follow David on Twitter @akadjian |

And in case anyone missed it... a vacation photo for your amusement...

http://www.chrisweigant.com/2015/03/19/happy-paddys-week-blarney-blarney-blarney/#comment-58117

:-)

-CW

I have to link to this in next week's Threatcon post at BreitbartUnmasked. Well done!

I like the sound of Threatcon posts. Are you blogging there these days Osborne Ink?

Feel free to link away!

-David

And thanks for letting me guest host while you're whupping it up in the land of leprechauns, CW!

David -

No, thank YOU for this article!

Next week, going to see Titanic museum and Giant's Causeway (Google it, or get out your copy of "Houses Of The Holy" to see it...).

More later...

:-)

Osbourne Ink -

Hey, good to see you around here again!

:-)

-CW

"Now, I don't know what all that means, but it sounds pretty bad..."

-Tom Cruise, A FEW GOOD MEN

:D

Really good breakdown, David.. I think.. :D You know me. Taxes and economics seem to go right over my head...

But your commentary did provoke two questions..

Before I get to them, I know how you hate it when things are simply broken down to a IT'S ALL THE DEMOCRATS/REPUBLICANS FAULT diatribe...

And I hate it when things are simply broken down to a IT'S ALL THE RICHs FAULT!!! THEY ARE NOTHING BUT A BUNCH OF DICK DASTARDLY TYPES!!! diatribe..

So, I promise to not reduce things to a Right V Left meme if you promise not to reduce things to a Rich V Middle Class meme.. :D

In 1952, corporate income taxes provided 32.1% of federal revenue. By 2013, corporate income taxes provided only 9.9%. In 1952, FICA payroll taxes provided 9.7% of federal revenue. In 2013, FICA payroll taxes provided 34.2%. Excise taxes including the estate tax provided 19.1% of federal revenue in 1952. By 2013, excise taxes provided only 5.5% of federal revenue.

Why??

For me, the "WHY" is always more important than the WHAT.. Because, for true change to occur, the WHY must be understood... (THAT little bit o philosophy is gonna come back and bite me on the arse, I can tell you!! :D)

So, why were these changes made?? Was there a logical/rational reason for them??

The belief is that the 1% will invest and create more jobs. The problem with this belief is that anyone who's taken even the most basic business courses knows that you hire people when there's an increase in demand, not when you receive a check, and taking money from consumers (70% of GDP spending) reduces demand.

So, basically you are saying that the economics of our country are built on the premise that a rising tide raises all boats...

This appears to have served our country well for the last 52 years...

What's changed that it's such a bad thing now??

Great read... I actually understood it... Well, most of it.. OK OK SOME of it... :D

Michale

CW,

Can ya check the NNL filter?? :(

Michale

David

I enjoyed your column. I think an 11th form of taxation is worth mentioning. Fines, engineered to ensnare the uninformed, the out of town-er, or the socially marginalized. These are increasingly being used by small municipalities to balance their rickety budgets. Speed traps are a classic example, updated, and made even more unpopular with the automated photo camera. I can't think of a more regressive form of taxation, or one that's harder to push back against.

Thanks, Stig. Totally agree. We saw this in egregious form in Ferguson where they were basically paying for the whole county by fining people into a state where you could never pay your way out.

Basically, you get a fine for not being able to pay the fine and soon we're back to debtors prisons.

There's a couple reasons for this, but I think the main one is that the wealthy simply don't want to pay. So they buy the politicians, get what they want, and then the rest is pushed onto the middle managers in government. These people have to find a way to pay the bills so many turn to fines, fees, and other "fine print" type regressive taxes.

The funny thing is, conservatives hate these types of things. I mean, hate. And I don't blame them. Especially the speed cameras.

What they often don't see (and what I'll try to show them) is that one of the big reasons for these speed cameras is all the tax cuts to the wealthy.

Great point. I could easily add fines to "fees, tolls, and licenses" because they behave similarly or as another category.

Glad you enjoyed the column!

-David

Basically, you get a fine for not being able to pay the fine and soon we're back to debtors prisons.

Oh don't even get me started on the total BS DL systems this country has..

Get this..

If you have a suspended license because you can't pay fines, you are NOT eligible for a work-license only...

But if you have wracked up a dozen DUIs, you CAN get a work-license..

Get that!?? If you can't afford to pay fines, you can't get a provisional license to GO TO WORK!!!

But if you are a drunk driver and a threat to civilized, "OH, hay you need a work license?? Sure, come on down!"

Where is the logic???

Michale

There's a couple reasons for this, but I think the main one is that the wealthy simply don't want to pay. So they buy the politicians, get what they want, and then the rest is pushed onto the middle managers in government. These people have to find a way to pay the bills so many turn to fines, fees, and other "fine print" type regressive taxes.

But let me ask you... (I went into this more in depth in the post that is stuck in NNL...)

Is it really the wealthy's fault???

I mean, ya'all are on record as defending the elite for taking advantage of the tax loopholes and such... I believe the exact words were "they are simply using what's legal" or words to that effect..

So I have to ask..

Who is really to blame??

The wealthy who simply use the system to their advantage??

Or the politicians that allow themselves to be used and bought???

I think you know where I stand on that question... :D

Michale

Speaking of Blarney. The number of Titanic museums is fast approaching "pieces-of-the-true-cross" level.

Branson MO for starters, and if sea faring Branson has one, so must maritime Pigeon Forge TN. You can partake in a Titanic Experience in Orlando Fl, but this was true long before Titanic INC broke ground there. There are more theme parks in and near Orlando than there were life boats on the you-know-what. Seeing any queue themed attraction with a child is a titanic experience punctuated by driving, flying, sweating upchucking and whining.

New York City has 3 Titanic related venues. Massachusetts has The Titanic Society, and Washington DC, in what I can only conclude is a sly nod to preferential lifeboat sexism, has a Women's Titanic Memorial. The National Museum of American History, a division of The Smithsonian Institution has a permanent display of Titanic artifacts to to go with the many, many other fine historical artifacts not related in any way to Titanic or its sister ships.

Belfast, which built the Titanic, has the world's largest Titanic museum. By all logic, it should be called the Titanic Titanic Museum but is not. You might think a ship building town would commemorate the many vessels it launched that did NOT sink on their first voyage, but as engineers are fond of saying, "if you can't fix it, sell as a feature." That said, my late father, an engineer and naval officer, who worked in metals, would probably call the museum a "monument to stupidity....." Before launching into a discussion of ice tray compartments culminating in a muttered "IDIOTS" and a deft hand gesture aimed at the driver who cut him off.

Cobh Town, Ireland aka Queenstown has a Titanic museum, IN THE ORIGINAL WHITE STAR OFFICES! Cobh is where the last 123 mostly Irish passengers boarded Titanic on their way to "a new life in America." In science fiction this is called "The B Ark" trope, where an overcrowded planet uses a space travel ruse to thin out its more redundant members. The Cobh Museum, like Orlando, offers patrons a Titanic Experience. In a startlingly macabre bit of phrasing, the first half of this experience is said to be, and I quote, "immersive." What were they thinking? I guess it could be worse..."cold AND immersive" for example. Drowning, or hypothermia, it's all good fun. For an extra fee they'll let a virtual funnel crush you to death.

The Southampton Titanic museum also goes with a B Ark theme to justify its existence. "Visitors to the museum will discover how many people worked on board and the huge variety of jobs the crew carried out." A wide variety of jobs they could not find on dry land. So many workers, and even fewer lifeboats.

I know all this because there is something called a Titanic Universe, which is a website and not something cosmologists have postulated to account for dark matter. In closing, I have learned that the common thread to all these places is a something called "A Store" where you can buy "Stuff."

Have fun CW, and keep an eye out for those giants working on the causeway. Chris Christie will be putting out cones.

Great article, thanks for helping the CW enjoy his vaca in the and of Guinness and Irish Whiskey (both of which taste better there, shipping does something to the taste of Guinness).

I was wondering as a mere point of curiosity, mind you; Why didn't you work in to your piece the fact that not only are the wealthiest benefiting the most, the average tax payer is also subsiding their continued wealth increase through the government contracts awarded to them.

Examples that come to mind would be General Electric who has effectively not only paid any taxes but has in some years even claimed a refund, yet a large portion of their profits come from government contracts awarded to them in not just the defense industry but also their financial services division.

or

How about all of the largest wall street banks and credit institutions that hold contracts for the management of processing for various states and the feds the processing of SNAP and other social safety net programs.

or

How about the private equity groups that administer various student loan programs? I find it somewhat odious that they are allowed to manage these programs in such a fashion that the quest for profit often results in driving people into poverty or bankruptcy all in the name of reclaiming the public dollar.

It seems to me that it is a salient point to make when discussing who benefits from the various tax breaks / rates that are written as not only are these breaks effectively lowering the amount of taxes they pay it increases the burden on the average taxpayer to maintain the "subsidies" they are receiving in the form of these contracts.

Perhaps it is just me but I feel that if a corporation is going to make a profit from helping to administer our government or by supplying goods and services they should at the very least be contributing back to the system in a fashion that is equal to what the average taxpayer is contributing.

If you have a suspended license because you can't pay fines, you are NOT eligible for a work-license only.

Now that is grade A baloney (or bologna, which never looks like it's spelled right to me)!

The wealthy who simply use the system to their advantage?

The don't just use the system. They write the system to their advantage.

Or the politicians that allow themselves to be used and bought?

The problem here is incentives. You need money to win elections. The easiest way to get money is to get a lot of it from a few donors. The problem is that these donors then want things in return.

This is why we have the government we have. If we want a government that works for people (and not just a few people), we need to get the money out of it.

-David

Why didn't you work in to your piece the fact that not only are the wealthiest benefiting the most, the average tax payer is also subsidizing their continued wealth increase through the government contracts awarded to them.

It would make a good article unto itself, good trickle. You are absolutely right that it goes on ... and on and on.

Here in Ohio we have a corporate charter school disaster because the state outsourced a bunch of schools and allowed these "charters" to be exempt from all of the rules required of the public schools.

What happened? The school companies took all the money and delivered very little education. Even people in the charter school business gave Ohio an 'F' for this insane practice.

This is, unfortunately, what unscrupulous companies do when they gain control of the government. They write themselves gravy contracts.

I didn't get into this mostly because I felt I'd already used a ton of ink ... err, pixels or whatever one uses on the Interwbs.

-David

The don't just use the system. They write the system to their advantage.

Poe-Tay-Toe, Poe-Taa-Toe

Are they doing anything illegal??

They are simply looking out for their own best interest... It's like when I slammed Buffett et al for claiming that they should pay more in taxes. If they think they should pay more in taxes, then they should pay more in taxes.. I was told that it's not right to expect them NOT to look out for their own best interests.

This is the same concept..

This is why we have the government we have. If we want a government that works for people (and not just a few people), we need to get the money out of it.

Yer preachin' to the choir on that point..

I see two possible solutions..

1. Public funds.. Candidates that run for office are allotted x number of dollars for their campaign and that's it...

2. Free air time.. Candidates for office are allotted x number of hours of free air time and that's it..

But try getting EITHER Party to agree to that! :D

Michale

Now that is grade A baloney (or bologna, which never looks like it's spelled right to me)!

I am going to take that to mean you agree with me that it's ridiculous.. :D

Michale

Prices are determined by supply and demand independently of tax rates.

And what determines supply? Costs. A firm will produce more, as long as the increase in revenue exceeds the increase in costs. Taxes are a cost, in this context.

Taxable "corporate income" isn't the entire revenue stream, if I understand correctly. It's net of some costs, so it roughly corresponds to profit.

The basic point is more-or-less correct, though. Corporate income tax doesn't mostly get passed along to customers, so it falls mostly on owners of financial assets. However, it does cause some deadweight loss. My guess is that individual income tax is a little better.

Don't get me wrong. I am not defending the rich...

Yea, it would be nice if they would be willing to re-distribute their wealth to help those not as fortunate or those who are too lazy to earn their own wealth..

Unfortunately, we don't live in a "nice" world..

We live in a world where the rich get richer, the poor get more and more freebies and the Middle Class pays for it all...

K Sarah Sarah....

Michale

I see two possible solutions.

I would love to see either or both. I press both parties on this type of thing as much as I can.

I am going to take that to mean you agree with me that it's ridiculous.. :D

Whups. That's exactly how it was meant though I can see how it could have been read differently.

Stupid computer. Type what I mean, not what I say! :)

They are simply looking out for their own best interest.

So were kings at the time :). Does this mean they were a good thing?

-David

OK, first off I rescued the two comments that had been caught in Filter Hell (or maybe, more accurately, Filter Purgatory...?). So go back and re-read the comments, everyone, because there are a few new ones in the mix now...

Anyway, wanted to answer a few of these, but before I do so, a small announcement:

I am semi-confident that I'll have a new travelogue column tomorrow for everyone. I should have the time to do so, so look for that. No pictures until I get back (technical problems posting them), but I'll have a rundown of the fairly momentous time we chose to be here. So there's that to look forward to!

OK, let's get on with it...

TheStig [11] -

Great rundown on the Titanic museum explosion (so to speak). I particularly liked the "Titanic Titanic Museum" suggestion.

As for Cobh, check out the first few paragraphs of this past column:

http://www.chrisweigant.com/2009/05/25/memorial-day-for-flu-victims/

I've been to Cobh, and it is a fascinating place. The Lusitania is a much bigger presence there than the Titanic, but that may have changed (it's been awhile since I was there). Interesting factoid: like many places, religious and secular, in many parts of the world, the cathedral in Cobh has an interesting pattern in some of the marble inside (I think I saw it on the floor, can't be 100% sure of that memory, though): rows of swastikas. Before Hitler ruined it, this image had a long history in several different cultures all over the world. It was jarring, though, to see it in a Christian church, I must admit. Definitely constructed before the 1930s, though, so no negative connotations should be ascribed. Just, like I said, an interesting little factoid.

goode trickle [12] -

You are correct. The Guinness here is much better. As the Irish say, "It doesn't travel." The further away from Erin you get, the more pronounced the flavor change. At least they serve it cold here, unlike the warm beer in England...

Michale [15] -

I heartily agree with you (gasp!) on the free ad time concept. Other countries use it, and minority (smaller) parties get an equal voice as the big guys. Which gives them a fighting chance in the election.

Anyway, that's it for now. More later, and as I promised, a new column tomorrow. Probably re-runs for the rest of this week, but we'll see how much time I can squeeze.

-CW

And what determines supply? Costs. A firm will produce more, as long as the increase in revenue exceeds the increase in costs. Taxes are a cost, in this context.

Taxes are on profit margin. They're not a cost. They come after the fact.

Now is there some likelihood that business owners try to work in more of a profit margin based on potential taxes? Possibly, but the impact by and large is negligible.

The biggest way to see this is, did prices ever go up or down because of changes to the corporate income tax?

It just doesn't happen.

-David

So were kings at the time :). Does this mean they were a good thing?

Wasn't it Abraham Lincoln who said,

"I am completely against slavery. But if there are slaves and masters I would certainly prefer to be the master."

Or words to that effect???

There is nothing inherently evil or wrong in looking out for the best interests of you and yours...

It goes back to the paying extra taxes issue I mentioned above...

Do we castigate the Buffets and the Soroses of the world because they won't pay more than is necessary???

CW,

I heartily agree with you (gasp!)

So, let me get this straight..

A SuperMoon....

The Spring Equinox...

A Solar Eclipse....

And you agree with me.....

Surely heralding the End Of Days.... :D

Michale

2. Free air time.. Candidates for office are allotted x number of hours of free air time and that's it.

For a time we had a market based equivalent of "free time" based off federally mandated charging structures for ad time and a requirement that ALL candidates that are "official" candidates be given EQUAL air time / space; interestingly the equal air time applied to debates as well. In exchange for this regulation of possible income earned the media only had to make available a reasonable amount of time and space available in each of their revenue segments (I.E. prime time, late night, Sunday newspaper).

The whole system started to erode in the mid 80's when congress amended the act to allow groups sponsoring Presidential debates to exclude third party candidates. The current rule set that seems to be applied to the debates for third party candidates that they need to "poll" at a certain levels to participate is strictly voluntary and the bar is set at such a high level that the candidate has to be sipping at the same trough as the rest of the bought and paid for, thus precluding any candidate that might instigate a true grassroots movement or gain enough popularity that the big two would have to alter not only their rhetoric but their corpratized behavior after winning office.

The system took it's second major blow when changes were made to the when the ad rate structure applied and when it did not. These changes were incremental and small at the times they were instituted but when put all together the effect is such that the large monied interests do not mind as much donating large sums of cash to each party as they will get it back through ad buys. The end result of this is again an exclusion of true third party candidates to participate effectively in our political system and have influence on the debate at large.

The third and final blow we are all very familiar with are the changes made to the regulations and structures governing PAC's and how they are allowed to get the word out. For a small time PAC's were covered under the fair access clauses but the media groups argued that they were not covered by the Fair and reasonable clauses as they were not candidates or political parties and thus they were free to charge them what ever rates they wanted and sell as much space as possible. With the advent of CU the "corporate citizens" get to pump as much money as they want into the system and will again get much of it back through the ad buys. The end result of this proverbial nail in the coffin is such that , in my opinion, we no longer have real campaigns on the issues we have public relations tours that whip the people up with rhetorical visions.

While I do support the idea of public finance I am against the free airtime. I would prefer to see us return to the regulations of the pre 80's in terms of governing advertising with an update to encompass the new social media avenues (IRT facts must be true, no personal attacks, no slander). I find it much more sporting to force the campaigns to actually think about how they will spend their money to get the "word" out. I think that if done right BOTH parties could agree.

BUT, unfortunately this leaves the corrosive effect of the PAC's abilities to spend money as they see fit still in play. Now if we were to create real regulation on the PAC's and strong punishments for violating those laws then we might be heading in the right direction. I for one would love to see regulation that if you are caught coordinating the operative goes to the hoosegow for 10 years minimum adn the candidate is no longer eligible to hold office. I would also go for the removal of coordination via the revolving staff door and "sponsored" speeches . Bringing them into the pre 80's time/space regulations would also have the very positive effect of giving us a break from the relentless onslaught we all suffer through now.

Well enough on that issue, as you can tell I am a big fan of the public square, and in the public square everyone gets the opportunity to speak equally not just the ones with money.

The don't just use the system. They write the system to their advantage.

"Mr President.. That is not.... entirely accurate"

-SecDef Nimzicki, INDEPENDENCE DAY

The rich don't write the system. The rich buy off politicians and it's the politicians who write the system..

Thereby re-affirming my point that it's the politicians who shoulder the majority of the blame..

The rich are simply (and legally) looking out for their own best interests..

Take this guy in New Hampshire. He was a teacher's union rep and is entitled to $31K a year pension..

But the rules say that, because he worked *ONE DAY* as a substitute teacher, he is also entitled to ANOTHER $31K a year pension...

Can you begrudge the guy for wanting to make his life and the lives of his family better?? He's simply playing by the rules of the game..

"Don't hate the playa, hate the game."

-Hip Hop song

:D

Michale

http://sjfm.us/temp/CatCoffee.jpg

:D

Michale

Something that really bothers me about the 1997 Titanic film.

The sea water temperature on that fateful night was 22F. So too would be the sea water flooding the lower decks. Rose and Jack spend quite some time wading and swimming through the lower decks.

https://encrypted-tbn0.gstatic.com/images?q=tbn:ANd9GcQjX7wpMJcvVLdjYLlE7mmm6OGFLVU-ypzgGSAyr1p5SN7MqXU3Bw

I can't find a hypothermia chart that goes below 32.5 F. At 32.5 F, without protective gear, dexterity goes in about 2 min. Rose with axe? "Sorry, Sorry,let me put some pressure on that!" Jack finding and using a key in the cold-wet-dark? It's hard enough to find and use your house keys in the dark. I've never tried it submerged in 22F water, but I'm betting the level of difficulty is off the charts.

Dexterity aside, at 32.5F you are unconscious within 15 minutes. Beyond hope of revival in 45.

I don't care how tightly you cinch up your belief suspenders, Jack and Rose couldn't have made it to the weather decks, alive or dead, without the aid or a first class search and rescue/recovery team.

CW- if you haven't already been, you might bring this up with the museum guides and get your full 9.5 Euros worth.

By the way, I still like the movie.

The '09 flu memorial piece was a good read. The US has almost complete amnesia about the 1918-19 outbreaks among US civilians.

My grandmother, who grew up in the Bronx,told me stories about coffins stacked up head high on the sidewalks. I dismissed this as an exaggeration at the time. Years later, I saw photos of these stacks in a PBS documentary. Grandma was a faithful reporter. The US death toll was upwards of 600,000 within a one year period.

TS,

By the way, I still like the movie.

You a SUPERNATURAL fan?? :D

Michale

Wow, what a terrifically useful post!

Very nice work, David!

M-26

Until you mentioned it, I didn't know it existed...

I'm pretty spotty when it comes to watching broadcast TV. There are long stretches in my life where I almost never tuned in. I never saw a single episode of MASH on air...missed almost all the Cheers years.

If it's not on a big screen, a disc or you can't stream it, I don't tend to see it...

I just came off a 3 year broadcast TV sabbatical and got an HD set so I can watch PBS at home, on a biggish screen. I really hate cable with its overpriced bundles. Streaming services are a much better alternative. Mad Men 7th season just turned up on NetFlix streaming. I see a binge in my future.

Until you mentioned it, I didn't know it existed...

it's a pretty awesome show.. In it's 10th season..

The reason I mentioned it is there was an episode where the Archangel Balthazar went back and time and, as First Mate I.P. Freely, saved the Titanic...

It was a hilarious episode... :D

I just thought of that when you mentioned the Titanic..

just came off a 3 year broadcast TV sabbatical and got an HD set so I can watch PBS at home, on a biggish screen. I really hate cable with its overpriced bundles. Streaming services are a much better alternative. Mad Men 7th season just turned up on NetFlix streaming. I see a binge in my future.

We haven't watched Network or Cable TV in over a decade... We download all of our shows.. I have a 4TB Video Server that is actually due for an HD upgrade, because the 4TB hard drive is getting full.. :D

I got my wife a 60" LED Samsung 3D Smart TV for Valentines Day and she has discovered the wonders of NetFlix.. :D She is really into BREAKING BAD..

If you are interested, I think SUPERNATURAL is available on Netflix as well..

Michale

Netflix streaming has all 195 episodes of Supernatural. At peak binge rate it would take me 2 months!

Breaking Bad is on my to watch list.

I got my wife a 60" LED Samsung 3D Smart TV for Valentines Day and she has discovered the wonders of NetFlix.. :D She is really into BREAKING BAD.

What have you done, Michale?!!!!

:)

-David

p.s. It's a great show, idn't it?

I just binged all 4 seasons of Game of Thrones. I tried House of Cards Season 3, but just couldn't get into it. It's a shame because the first two seasons are really good.

What have you done, Michale?!!!!

:)

Yea, tell me about it..

I couldn't sit in front of it. A show glorifying a drug dealer!???

It's why I gave up on TWO AND A HALF MEN because of all the drugs!!

Michale

Netflix streaming has all 195 episodes of Supernatural. At peak binge rate it would take me 2 months!

For the record, they are up to episode #215... :D

And what about that X-Files revival, eh!!!??? :D

Michale